how to pay income tax online malaysia

You must have an ATM card from the respective bank to proceed with payment and need to provide your income tax reference number to complete the transaction. Get your PIN number from the nearest LHDN branch so you can log into ezHASiL.

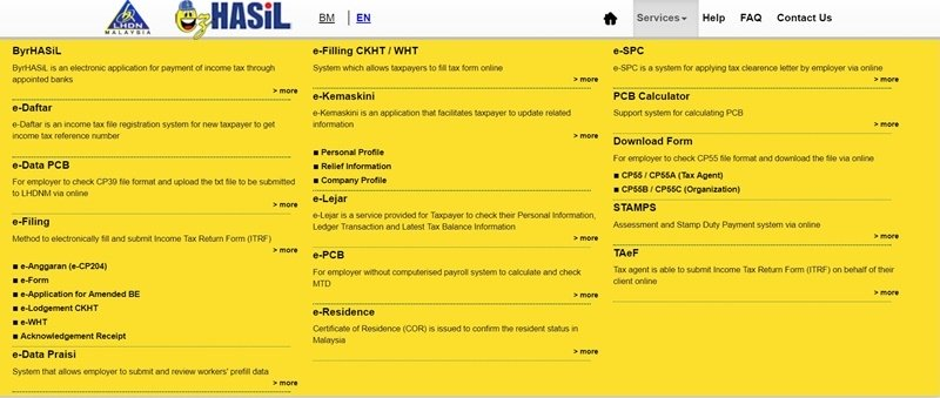

Guide To Using Lhdn E Filing To File Your Income Tax

Enter your Income Tax file number excluding alphabets.

. After registering LHDN will email you with your income tax number within 3 working days. Access Top US Expat Tax Service In Minutes. Contract payments to non-resident contractors are subject to a total withholding tax of 13 10 for tax payable by the non-resident contractor and 3 for tax payable by the contractors.

But before that click on the link that says. But theres a much easier way to register. In that pages last choice Non-TDSTCS pick.

This will calculate the combined tax for both salary and bonus in the payslip after that you may deduct the tax of the monthly salary component to get the bonus-only tax. 7 Tips to File Malaysian Income Tax For Beginners Melly Ling March 24 2021 1. Visit this e-Drafter link and fill in all the required fields.

Access Top US Expat Tax Service In Minutes. Income Tax payment. Then login your CIMBClicks account.

Your name identity card number and Income Tax Reference Number will appear on the screen. Payment Code Assessment Year Instalment Number. Select From Account to make payment and enter the following information.

Can we pay tax online. How To Mak Fre Income how to make tax free income online income online bd payment bkash 2022If you are looking for how to earn money online this video will b. Ad Report All Foreign Income To IRS Correctly With Most Accurate Tax Software For US Expats.

You can either make the payment through online. If this is your first time filing your taxes online there are two things that you must have before you can start. It will be applied to.

You can apply it at any CIMB branch. Pay Income Tax via CIMBClicks First thing first you need to have a valid CIMBClicks account. The e-payment portal at IRBM website enables taxpayer to pay income tax through FPX gateway.

Confused About US Expat Taxes. If the page shows Sijil. Your income tax number and PIN to register for e-Filing the online.

Register as a Taxpayer on e-Daftar to get your Income Tax number. Click hantar after you confirm your details. Tax Payment Via Credit Card Taxpayers can make payments of income tax and real property gains tax using a credit card online at httpsbyrhasilhasilgovmycreditcard These services.

Average Lending Rate Bank Negara Malaysia Schedule Section 140B Restriction On Deductibility of Interest Section 140C Income Tax Act 1967 International Affairs. 80 Work Productivity Ideas. The personal income tax rate in Malaysia is progressive and ranges from 0 to 30 depending on your income for residents while non-residents are taxed at a flat rate of around 30.

A Pay income tax by online banking account FPX Income tax payment can be made through internet banking in Malaysia. How to file Nill or Zero Tax Teturn in FBR Pakistan how to file income tax nill return 2022Our se. Before you can file your taxes online there are two things that you will need.

Log into your ezHASiL. Introduction to Monthly Tax Deduction MTDPCB - Part 1 of 3 10th Aug 2022. User need to register for internet banking service with any commercial banks listed as FPX.

Ad Report All Foreign Income To IRS Correctly With Most Accurate Tax Software For US Expats. D Payment via tele. Confused About US Expat Taxes.

The personal income tax rate in Malaysia is progressive and ranges from 0 to 30 depending on your income for residents while non-residents are taxed at a flat rate of around. 8 rows Payment of individual Income Tax and Real Property Gain tax RPGT can be made via Auto Teller Machine ATM at Public Bank Maybank and CIMB Bank. However if you want to file your taxes online follow the steps below.

Taxing The Rich The Evolution Of America S Marginal Income Tax Rate Infographic

Corporation Tax Europe 2021 Statista

How To File Income Tax For The First Time

How To File Your Taxes For The First Time

Malaysia Personal Income Tax Guide 2020 Ya 2019

Malaysia Personal Income Tax Guide 2020 Ya 2019

Tax Implications On Money Transferred From Abroad To India Extravelmoney

Public Bank Berhad Lhdn Income Tax And Pcb Payment

How To Pay Your Income Tax In Malaysia

Income Tax Formula Excel University

Lhdn Officially Announced The Deadline For Filing Income Tax In 2021 Attached Is A Guide To Tax Filing Online Everydayonsales Com News

Malaysia Personal Income Tax Guide 2020 Ya 2019

Pdf Determinants Of Online Tax Payment System In Malaysia

Guide To Using Lhdn E Filing To File Your Income Tax

Malaysia Import Tax Rate 2019 Norway Personal Income Tax Rate 1995 2021 Data 2022 2023 Forecast Historical One Of The Most Crucial Tasks For A Business Own Devilishcompanyzy

Malaysia Tax Guide How Do I Pay Pcb Through To Lhdn Part 3 Of 3

Cukai Pendapatan How To File Income Tax In Malaysia

Malaysia Personal Income Tax Guide 2020 Ya 2019

Journal Entry For Income Tax Refund How To Record In Your Books

Comments

Post a Comment